A Critical Review of 11 Analyst Recommendations for Williams Companies – Williams Companies (NYSE:WMB)

In the last three months, 11 analysts have published ratings on Williams Companies WMBit offers a range of expectations from bullish to bearish.

Summarizing their latest reviews, the table below shows trends over the past 30 days and compares to previous months.

| Bullish | It’s almost bullish | Indifference | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Summary of Points | 3 | 4 | 4 | 0 | 0 |

| 30D ago | 0 | 1 | 0 | 0 | 0 |

| 1M ago | 1 | 1 | 1 | 0 | 0 |

| 2M ago | 2 | 1 | 1 | 0 | 0 |

| 3M ago | 0 | 1 | 2 | 0 | 0 |

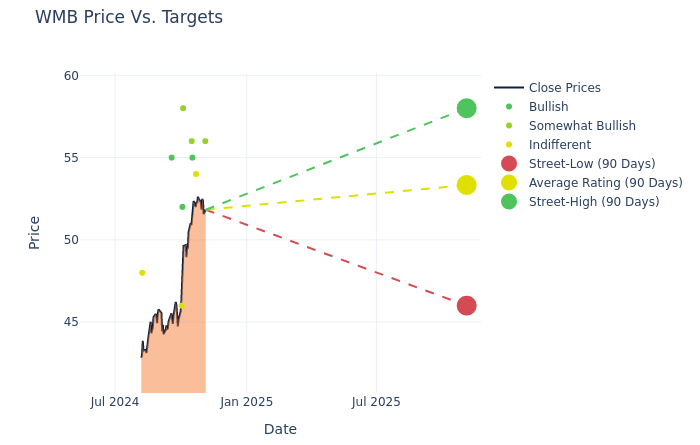

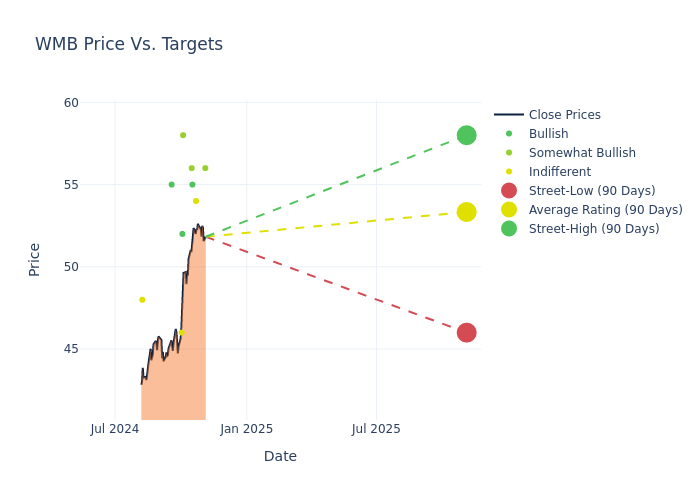

In reviewing 12-month price targets, analysts reveal Williams Companies’ data, presenting an average target of $51.73, a high estimate of $58.00, and a low estimate of $42.00. This upward trend is evident, with the current average showing an increase of 13.19% from the previous price target of $45.70.

Understanding Analyst Ratings: A Complete Breakdown

A comprehensive analysis of how financial experts view Williams Companies is based on the latest actions of analysts. The following is a detailed overview of key analysts, their latest reviews, and changes in ratings and price targets.

| Inspector | Analysts’ Firm | Action Taken | Details | Current Price Target | Purpose of First Purchase |

|---|---|---|---|---|---|

| Gabriel Moreen | Mizuho | It raises | More than | $56.00 | $47.00 |

| Robert Catellier | CIBC | It raises | Neutral | $54.00 | $45.00 |

| Jean Ann Salisbury | B of A Securities | It publishes | We could | $55.00 | – |

| Elvira Scotto | RBC Capital | It raises | More than | $56.00 | $47.00 |

| Robert Kad | Morgan Stanley | It raises | Excess weight | $58.00 | $52.00 |

| Spiro Dounis | Citigroup | It raises | We could | $52.00 | $45.00 |

| Theresa Chen | Barclays | It raises | Equivalent-Weight | $46.00 | $42.00 |

| Shneur Gershuni | UBS | It raises | We could | $55.00 | $51.00 |

| Elvira Scotto | RBC Capital | It raises | More than | $47.00 | $44.00 |

| Theresa Chen | Barclays | It raises | Equivalent-Weight | $42.00 | $41.00 |

| Tristan Richardson | Scotiabank | It raises | Scale Complete | $48.00 | $43.00 |

Important information:

- Action Taken: Analysts respond to changes in market conditions and company performance, often revising their recommendations. Whether they ‘Remove’, ‘Raise’ or ‘Decrease’ their rating, shows how they react to recent changes related to Williams Companies. These data provide a snapshot of how analysts view the current state of the company.

- Details: When we disclose information, analysts assign a high-quality rating to a stock’s performance, ranging from ‘Outperform’ to ‘Underperform’. This data provides an outlook on the relative performance of Williams Companies compared to the broader market.

- Price Expectations: Analysts see price corrections, provide estimates of future value of Williams Companies. Comparing current and previous targets provides insight into the evolving expectations of analysts.

Analyzing these analyst ratings along with relevant financial metrics can provide a comprehensive view of Williams Companies’ market position. Stay informed and make data-driven decisions with the help of our Fact Sheet.

Stay up-to-date with Williams Companies auditor information.

Entering the Background of Williams Companies

Williams Companies is a mid-sized energy company that owns major Transco and Northwest pipelines and gathers, processes and stores natural gas assets. In August 2018, the firm acquired the remaining 26% of its limited partner, Williams Partners.

Financial Benefits: The Williams Companies Journey

Market Organization Analysis: The company’s market capitalization exceeds the industry average, showing a larger size than peers and suggesting a strong market position.

Reduce Revenue: Within 3 months, Williams Companies faced difficulties, resulting in a decrease of approx. -5.92% in revenue growth as of June 30, 2024. This means a reduction in the company’s top earnings. Compared to its peers, revenue growth lags behind its industry peers. The company has achieved a lower than average growth rate among Energy sector peers.

Net Margin: Williams Companies’ net income is below industry averages, indicating difficulties in achieving strong profitability. With the internet network a 17.17%, the company may face difficulties in controlling costs effectively.

Return on Equity (ROE): Williams Companies’ ROE has lagged behind the industry average, suggesting challenges in maximizing return on working capital. With ROE of 3.25%, the company may face obstacles to achieve optimal financial performance.

Return on Assets (ROA): Williams Companies’ ROA lags behind the industry average, suggesting difficulties in maximizing returns from its assets. By ROA of 0.76%, the company may face obstacles to achieve optimal financial performance.

Credit Management: The debt ratio of Williams Companies is significantly higher than the industry average. With the ratio of 2.14the company relies heavily on borrowed money, which indicates a high level of financial risk.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and often specialize in reporting specific stocks or sectors. Analysts may attend company meetings, company financial statements, and consult with insiders to publish “analyst ratings” for stocks. Analysts typically rate each stock once a quarter.

Analysts can improve their analysis by including statistical estimates such as growth estimates, earnings and revenue, to provide additional guidance to investors. It is important to acknowledge that, although experts in stocks and branches, analysts are people and give their opinion when they give information.

The Breakout: Wall Street’s Next Big Move

Benzinga’s #1 analyst recently identified a stock that is poised for strong growth. This under-the-radar company can add 200%+ as major market swings continue. Click here for quick details.

This article was produced by the Benzinga news engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide financial advice. All rights reserved.

#Critical #Review #Analyst #Recommendations #Williams #Companies #Williams #Companies #NYSEWMB